gambling income tax calculator

You will pay gambling tax as you file income taxes. Its possible that gambling winnings when added to annual income could vault some players into a higher tax bracket.

Massachusetts Enacts Work Around To Federal 10 000 Salt Deduction Limitation Don T Tax Yourself

For non-resident aliens the current withholding tax is 30 federal and 6 state.

. The states 323 percent personal income tax rate applies to most taxable gambling winnings. It also means having to pay taxes on those winnings. You may deduct gambling losses only if you itemize your deductions on Schedule A Form 1040 and kept a record of your winnings and losses.

This calculator computes only an estimate of the income tax on gambing winnings for individuals with fairly straightforward tax situations. With the addition of Virginia online sports betting and brick-and-mortar casinos on the way Virginia bettors have more opportunities to make winning bets and earn gambling profits than ever before. The state tax rate ranges from 4 to 882 depending on your New York taxable income.

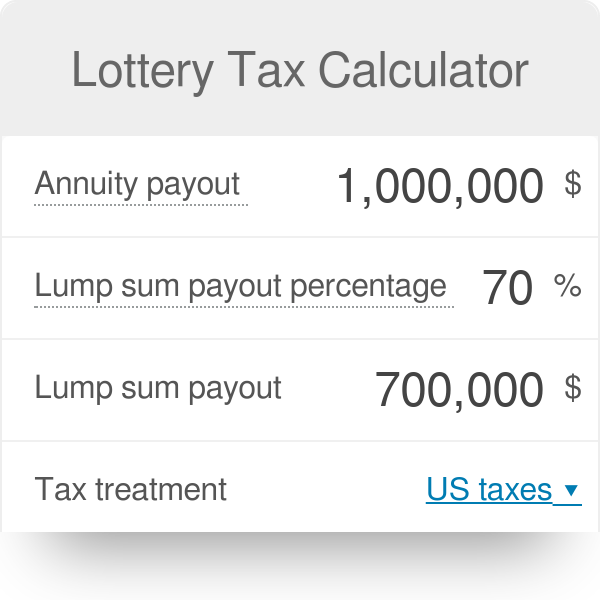

Ad Enter Your Tax Information. For example if you win 620 from a horse race but it cost you 20 to bet your taxable winnings are 620 not 600 after subtracting your 20 wager. Just like other gambling winnings lottery prizes are taxable income.

Taxable Gambling Income. Professional Gambler Tax Calculator - Estimate the tax impact of filing as a Professional or Recreational Gambler. Here is a breakdown of how the Maryland state tax structure works for someone filing single.

Claim your gambling losses up to the amount of winnings as Other Itemized. If you didnt give the payer your tax ID number the withholding rate is also 24. Marginal tax rate is the bracket your income falls into.

This calculator is best for individuals who have dividend or capital gains income rental property income self-employment income farming income who receive Social Security benefits or have made contributions to a traditional IRA. The state passed a law that states that all winnings received after 2017 and that are more than 5000 have a 24 percent federal gambling tax rate. So you are finally a consistent winner at your local poker room casino or race track.

31 2019 taxes on gambling income in Illinois are owed regardless of what state you live in. Gambling income is subject to state and federal taxes but not FICA taxes and the rate will depend on your total taxable income not just wages minus deductions standard or itemized. For example if players win 150000 but lose 50000 in bets the taxable income allowed as a miscellaneous deduction is 100000 for that specific playthrough.

The state tax rate in Michigan is 425 which is the rate your gambling winnings are taxed. Dulles is located within Loudoun County VirginiaWithin Dulles there are around 5 zip codes with the most populous zip code being 20101The sales tax rate does not vary based on zip code. This includes the rates on the state county city and special levels.

Yes gambling winnings fall under personal income taxed at the flat Illinois rate of 495. The average cumulative sales tax rate in Dulles Virginia is 6. What amount do you need to win to receive a W2-G.

Max planck institute of biochemistry phd. In Arizona the Lottery is required by law to withhold 24 for federal taxes and 48 for state income taxes for United States citizens or resident aliens. United States 292 F2d 630 631-632 5th Cir.

With the addition of Virginia online sports betting and brick-and-mortar casinos on the way Virginia bettors have more opportunities to make winning bets and earn gambling profits than ever before. This calculator computes only an estimate of the income tax on gambing winnings for individuals with fairly complex tax situations. Whether a lucrative sports parlay bet or a winning Virginia Lottery ticket all gambling income is considered taxable and.

As for state taxes in Ohio you report gambling winnings on Form IT 1040 but only winnings accrued in Ohio. Whether a lucrative sports parlay bet or a winning Virginia Lottery ticket all gambling income is considered taxable and. In addition you submit any Ohio state tax withholdings on gambling winnings on this same form.

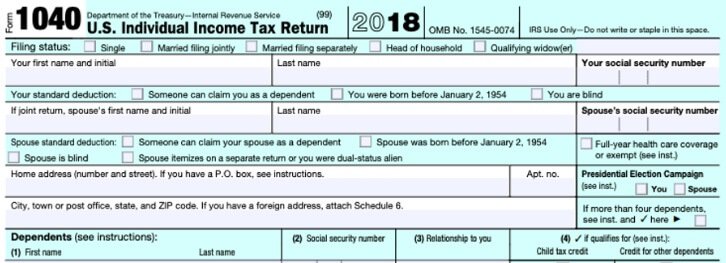

This includes cash and the fair market value of any item you win. By law gambling winners must report all of their winnings on their federal income tax returns. Gambling income is almost always taxable income which is reported on your tax return as Other Income on Schedule 1 - eFileIT.

Its determined that gambling losses are a miscellaneous deduction. Players should report winnings that are below 5000 and state their sources. Other Resources - Other information related to gambling taxes.

These prizes arent subjected to the 2 Limit by being listed in the Schedule A Taxation. One small consolation is PAs 307 state tax on lottery winnings is less than half than neighboring states such as New York 882 New Jersey 80 and West Virginia 65. E-File your tax return directly to the IRS.

This will itemize your gambling income. The second rule is that you cant subtract the cost of gambling from your winnings. Whether theyre winnings from a slot machine horse track poker table or sportsbook they all count as income and are subject to state taxes.

New Jersey Gambling Tax Calculator. What tax form do you get for gambling income. If your winnings are reported on a Form W-2G federal taxes are withheld at a flat rate of 24.

How to factory reset rca tablet without password. For example if you hit the trifecta on Derby Day you must report the winnings as income. Tax rates depend on your annual income and tax bracket.

On your federal form you submit this as other income on Form 1040 Schedule 1. Maryland levies between 2 and 575 in state taxes including gambling winnings. You will receive a Form W-2G if you receive gambling winnings over a certain amount or if you have income taxes withheld on your gambling income.

The actual amount you will owe in tax liability will depend on your tax bracket and could be lower or higher. Winnings are subject to both federal and state taxes. Red mini schnauzer puppies.

Cash is not the. It also means having to pay taxes on those winnings. The operator will use a gambling winnings calculator to determine the amount of tax you will pay after winning a big jackpot.

See What Credits and Deductions Apply to You. Congratulations - you are in the minority. The amount of losses you deduct cant be more than the amount of gambling income you reported on your return.

Under the US Tax Code all income for US citizens is taxable whether earned in the US overseas or on the Internet. The taxes on winning calculator shows the state tax that Colorado charges on winnings of up to 50 free spins in certain games and it is remitted two days after qualifying. This calculator is not appropriate for individuals who are aged 65 years or more have dividend or capital gains income rental property income self-employment income farming income who receive Social Security benefits or.

1200 or more not reduced by your. The minimum amount to receive a W2-G depends on the game. Effective rate is the actual percentage you pay after deductions.

Prepare federal and state income taxes online. Section 61 a defines gross income as all income from whatever source derived including gambling unless otherwise provided. Any winnings subject to a federal income-tax withholding requirement.

When gambling winnings are combined with your annual income it could move you into a higher tax bracket so its important to be aware of. Marginal tax rate is your income tax bracket. More than 5000 in winnings reduced by the wager or buy-in from a poker tournament.

Income Tax With Notebook And Glasses Sponsored Sponsored Ad Income Notebook Glasses Tax Refinance Mortgage Mortgage Savings Mortgage Marketing

Flyfin Unveils Free 1099 Tax Calculator To Help Filers With Self Employment Tax

Simple Tax Refund Calculator Or Determine If You Ll Owe

8 Tax Tips For Gambling Winnings And Losses

Reporting Gambling Winnings And Losses To The Irs Las Vegas Direct

Free Gambling Winnings Tax Calculator All 50 Us States

Income Tax Calculator 2021 2022 Estimate Return Refund

Income Tax Calculator 2021 2022 Estimate Return Refund

Lottery Tax Calculator Updated 2022 Lottery N Go

Self Employed Tax Calculator Business Tax Self Employment Employment

Council Post When Does It Make Sense For Business Owners To Hire A Tax Accountant Emeklilik Yangin Marmaris

Tax Calculator Gambling Winnings Free To Use All States

Free Gambling Winnings Tax Calculator All 50 Us States

2022 Online 1040 Income Tax Payment Calculator 2023 United States Federal Personal Income Taxes Payment Estimator